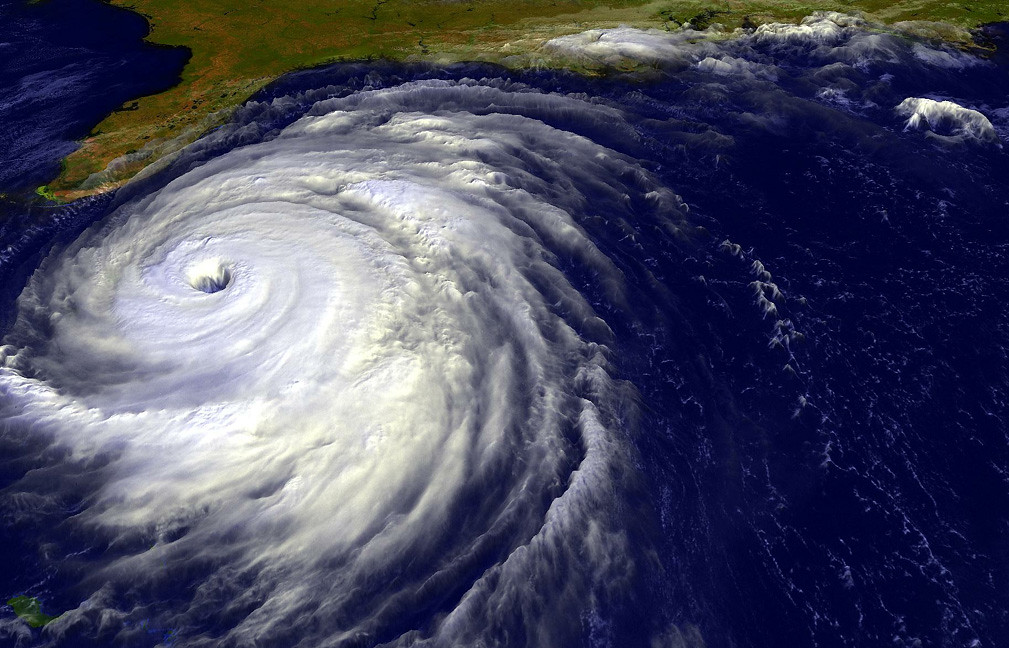

Weather Claims Roundup: A Look at America's Recent Natural Disasters

September 21st 2023

Americans are working overtime to try to keep pace with the natural disasters occurring in the wake of climate change. According to the latest reports, U.S. insurers paid $176 billion in natural disaster claims between 2020 and 2021.

Unfortunately, that number is predicted to only increase. The National Centers for Environmental Information reports that over the past five years, the U.S. has experienced an average of $18 billion in climate disasters each year. Specifically, over the past decade, severe storms have caused the highest number of billion-dollar climate disasters (99), followed by tropical cyclones (24), flooding (17), droughts (10), and wildfires (9). These weather events not only cause immediate effects but have lasting repercussions for communities.

Forbes reports that between January 2013 and January 2023, 88.5% of all U.S. counties declared a natural disaster, including 95% of the 200 most populated counties. This kind of emergency declaration makes federal funds available to support cleanup and rebuilding efforts.

The surge in wild weather has put insurers on notice. Some have even opted to pull their business out of disaster-prone regions altogether like California and Florida. As the weather shows no sign of abating, here’s a roundup of the most recent natural disasters and where things stand for U.S. insurers.

Hurricane Idalia (Category 3 landfall), August 30, 2023

The latest estimates of insurance losses for Hurricane Idalia, which made landfall near Florida’s Big Bend region, have moved higher than an initial $2.2 billion estimate. The losses for wind damage and storm surge for onshore property across Idalia’s track range were updated to be between $2.5 billion to $5 billion. The Florida Office of Insurance Regulation website shows that $202 million in estimated insured losses have been claimed on 20,976 separate claims cases filed. Across the U.S., 11.9 million properties are at severe to extreme risk for flood. A new study from Nature Climate Change shows that climate change is increasing the risk of flooding and Texas and Florida could experience a 50% increase in flood exposure by 2050.

Hurricane Hilary (Tropical Storm landfall, August 18, 2023

Hurricane Hilary, which deescalated to a tropical storm before making landfall, dumped unprecedented amounts of rain on Southern California. It marked the wettest August day ever documented in Los Angeles and San Diego resulting in close to $600 million in losses. The downpour triggered mudslides and rockslides and 70 mph winds uprooted trees, toppled power lines, and left tens of thousands of Californians without power.

Maui Wildfires, August 8, 2023

The unexpected and rapidly moving wildfires that swept across Maui last month are projected to result in approximately $1.3 billion in homeowners’ losses from more than 3,000 homes. The only other event to surpass this total in Hawaii’s recent history is Hurricane Iniki in 1992, which resulted in insured losses of about $3 billion. The official death toll sits at 115 with an additional 66 individuals still missing or unaccounted for. Insurers in Hawaii are reassessing a market that was previously believed to be relatively predictable. Generally, 4.5 million U.S. properties are at high to extreme risk for wildfire.

California Wildfires, July to September 2023

Earlier this month, a major blunder wreaked havoc on efforts to put out one of the season’s largest wildfires in northern Del Norte County, California. At least 82 vehicles were filled with gasoline instead of diesel fuel, according to experts, pausing efforts to extinguish the fire and adding to the overall expense. Wildfires have caused more than $30 billion in insured losses in California since 2017 and $38 billion globally from 2018-2022. It’s not just the increase in the number of fires that’s worrisome, but the size of each wildfire. NPR recently reported that of the 18,000 California fires that sparked between 2003 and 2020, 380 included at least one day when they grew by at least 10,000 acres. California has an average of 8,273 wildfires per year and last week, state legislators failed to pass a bill to incentivize insurers to stick around.

Tornado Outbreaks, March to June, 2023

The National Weather Service explains that there are about 1,000 tornadoes across the United States each year, resulting in 85 deaths and over 1,500 injuries. Nearly 70% of tornadoes occur between March and June, but they have been known to spring up in other months as well. Oklahoma leads the states in tornadoes with an average of 68 per year. Florida follows closely behind averaging 60 a year and Nebraska with about 55 tornadoes annually. Tornadoes are typically accompanied by severe thunderstorms and hail.

Severe thunderstorms are among the most common and damaging natural disasters in the United States, accounting for more than half of annual reported insured losses since 1985. Not to mention, the area known as “Hail Alley,” on the East Coast, has widened and 6.8 million properties had at least one damaging hail event in 2022.

Hurricane Ian (Category 4), September 29, 2022

Rebuilding from last year’s Hurricane Ian continues. The National Hurricane Center reports that Ian was responsible for over 150 deaths and over $112 billion in damage, making it the costliest hurricane in Florida’s history and the third costliest in United States history. In all, the hurricane drove about $50-$65 billion in global insured losses.

The experts predict that Mother Nature won’t be slowing down and populations in severe weather-prone areas continue to grow while there remains a lack of adequate building codes. These factors will continue causing headaches not only for insureds, but their carriers in the years to come.

-

June 2nd 2023

Insurers Prepare for Hurricane Season

June officially marks the beginning of Hurricane Season, and the National Oceanic and…

-

August 8th 2023

Three Simple Ways to Provide Support to Your Customers During This Hurricane Season

Earlier this week, a massive storm system brought high winds and thunderstorms across…

-

March 10th 2023

The People Behind Davies: Interview with Don Lederer regarding Johns Eastern Merger

Following the exciting news of Davies’ acquisition of Johns Eastern, we sat down…

-

January 8th 2024

Unleashing Efficiency: The Power of Streamlined Claims Process

Efficient claims processing is essential for the insurance industry. It enhances customer satisfaction…